2024 Marker Review

January 25, 2025 Author: Tess Downing, MBA, CFP®, Complete View Financial

How would we sum up 2024 in a word? Remarkable.

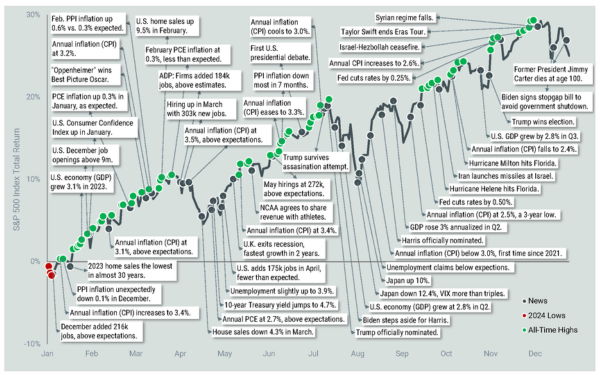

This past year, the S&P 500® Index delivered a 25% return, following a strong 2023. Along the way, we saw 61 new all-time highs, proving once again the power of staying invested despite uncertainties. From inflation cooling closer to the Federal Reserve’s 2% target, to resilient GDP growth and moderated rate cuts, the year offered opportunities for growth and recovery.

Image: S&P 500 Index Total Returns. Source FactSet, Avantis Investors

Key Highlights: Unpacking the Market's Successes and Challenges

- Market Resilience Amid Volatility

- The S&P 500 Index saw significant growth, achieving 61 all-time highs while rebounding from early dips. This is the second year in a row with gains of more than 20%.

- Inflation steadily declined, with the annual CPI dropping below 3% by December—a milestone not reached since 2021.

- Economic Growth and Policy Shifts

- U.S. GDP grew at a steady annualized rate of 3.1%, reflecting economic resilience.

- The Federal Reserve implemented three rate cuts, signaling a shift toward stable inflation levels and fostering market confidence.

- Sector Strength and Global Influences

- Technology and communication services sectors led the market, driven by innovation and consumer trends.

- International equities underperformed, with the MSCI World ex USA Index returning just 4.7%, underscoring the importance of diversification.

- External and Cultural Influences

- Geopolitical events, natural disasters, and consumer spending trends—such as Taylor Swift’s Eras Tour—shaped the broader market narrative.

- Political developments, including major nominations and policy shifts, added complexity but were absorbed by resilient markets.

- Diversification and Long-Term Discipline

- Staying invested proved rewarding, as highlighted by the strong performance of U.S. equities.

- Bond markets delivered modest returns of 1.3% (Bloomberg US Aggregate Bond Index), reflecting adjustments in inflation expectations and rate policy.

Market Returns: Navigating Gains Across Sectors and Regions

- The S&P 500 Index ended the year strong, with a 2.4% fourth-quarter return despite a 2.38% decline in December. For the full year, it achieved an impressive 25.02% gain.

- U.S. Small-Cap Equity (Russell 2000) lagged, closing the year with an 11.54% return after a modest 0.33% increase in Q4.

- International markets struggled in December and the quarter. The MSCI World ex USA declined 7.43% in Q4, ending the year with a 4.70% return. Emerging markets outperformed slightly, gaining 7.50% for the year despite an 8.01% quarterly drop.

- Fixed income markets delivered mixed results, with the Bloomberg U.S. Aggregate Bond Index declining 3.06% in Q4 but holding a year-to-date gain of 1.25%.

- U.S. cash investments provided steady returns, with a 5.32% gain for the year, reflecting increased short-term Treasury yields.

Global Economic Overview: Inflation, Growth and Policy in Perspective

U.S. Economic Landscape:

- GDP growth remained robust, with Q4 estimated at a 2.4% annualized rate, contributing to a solid 3.1% growth for the year.

- Inflation trends continued to improve, with the annual CPI dropping to 2.7% by year-end from earlier highs.

- The Federal Reserve cut interest rates three times in the second half, closing 2024 with a target range of 4.25%-4.50%. This marked a significant shift in monetary policy compared to 2023.

Global Context:

- The European Central Bank and the Bank of England also adjusted rates, reflecting a global trend of moderated monetary tightening.

- International equity markets underperformed, influenced by slower economic recoveries and geopolitical uncertainties.

- Yield curves in developed markets shifted toward normalization, indicating potential changes in long-term investment dynamics.

- These highlights summarize the resilient performance of U.S. markets against a backdrop of easing inflation, steady growth, and shifting global economic policies.

As we enter 2025, uncertainties remain, but the fundamentals of diversification, patience, and a long-term perspective continue to guide successful investment strategies. Thank you for trusting us with your financial journey. Here’s to another year of resilience, growth, and opportunities!