Are Higher Interest Rates Bad For The Stock Market?

May 1, 2023 Author: Tess Downing, MBA, CFP®, Complete View Financial

Investors reading their financial news publications of choice over the last year or so may have come across a headline titled something like “How Higher Interest Rates Will Affect the Stock Markets”. These articles typically go on to talk about how higher interest rates lead to higher borrowing costs for companies, which lead to lower profits/valuations and in turn poor equity performance.

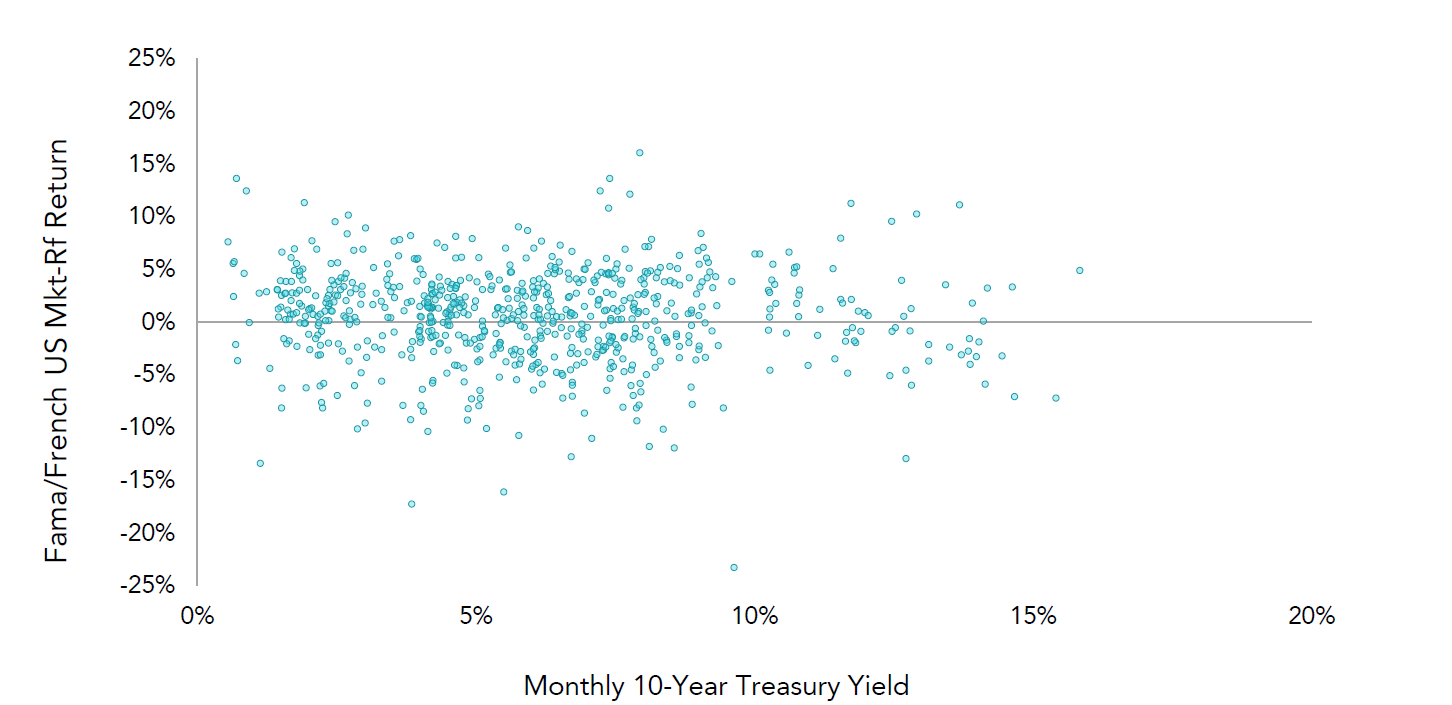

However, historical data suggests this is not necessarily the case. Exhibit 1 below plots monthly returns of the US equity risk premium on the vertical axis against monthly returns of the 10-Year US Treasury Yield on the horizontal axis. As illustrated, we don’t observe a discernible relationship between higher bond yields leading to lower equity returns.

Exhibit 1: Monthly Fama/French US Research Market Factor Returns against the 10-yr Treasury Yield

July 1963 – March 2022

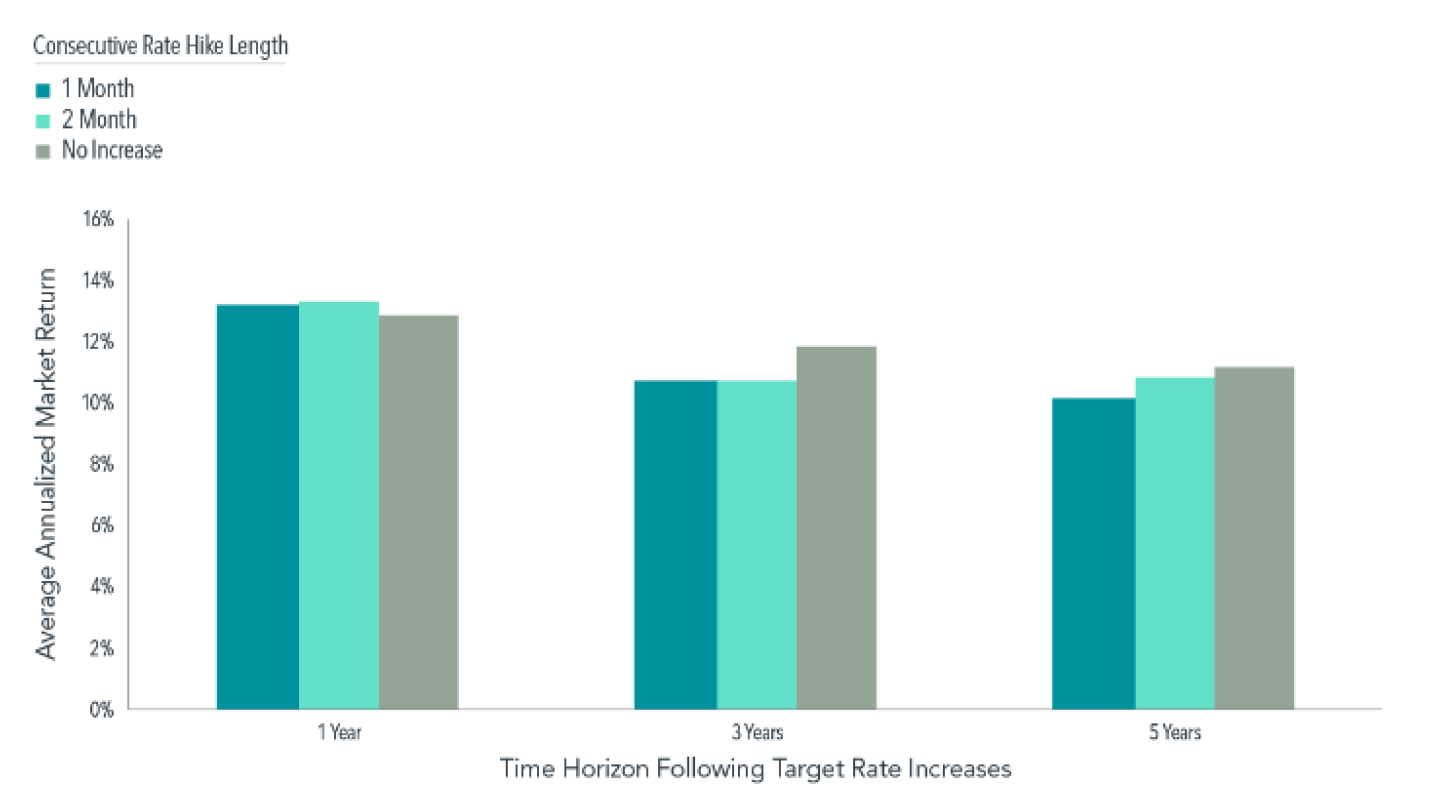

For investors concerned about how upcoming Fed policy decisions might affect future equity returns, Exhibit 2 below may offer some reassuring news. The chart shows average annual equity returns, measured by the Fama/French Total US Market Research Index, following different monthly rate hike scenarios. We see that performance following months in which the Fed raised rates is not meaningfully different from the performance following months without a rate hike.

Exhibit 2: US Equity Market Returns Following Consecutive Fed Funds Rate Hikes

January 1983 – December 2021

All else remaining the same, it might seem logical to think that higher borrowing costs from higher interest rates may lead to lower profits/valuations and poorer equity performance. However, periods of higher interest rates or rate changes don’t happen in isolation and many other influences can create noise in realized equity returns. Even if one could have perfect foresight of future interest rate movements, the data above suggests this information would be of little help to base short-term investment decisions on.

Stock prices continually adjust and respond to new information available to investors. Trying to predict all of the different potential sources of information and the magnitude of their impacts to make investment decisions is unlikely to lead to a positive investment result in the long term.

Data Appendix – Fama/French Factors

Fama/French Mkt-Rf: The excess return on the market, value-weight return of all CRSP firms incorporated in the US and listed on the NYSE, AMEX, or NASDAQ that have a CRSP share code of 10 or 11 at the beginning of month t, good shares and price data at the beginning of t, and good return data for t minus the one-month Treasury bill rate (from Ibbotson Associates).

Index Descriptions

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French Website.

Results shown during periods prior to each index’s index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index has been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.