Common Investing Mistakes

April 26, 2024 Author: Tess Downing, MBA, CFP®, Complete View Financial

During the first quarter, we reviewed the market landscape of 2023, a checklist for setting short-term financial goals, and insights into taxes.

April has brought beautiful spring weather and the unexpected delights from the Easter Bunny.

As my girls embarked on their annual Easter egg hunt, I couldn't help but draw parallels between the excitement of the hunt and the pursuit of financial success. Like hunting for the elusive golden egg, managing your investments demands patience, strategy, and discipline to navigate the twists and turns.

As we enter the year's second quarter, we want to ensure that your “nest egg” continues growing. This month we highlight 3 common investing mistakes that many people make when investing their assets. As your earnings and assets grow, your financial needs and challenges become more and more complex—and continuing to invest alone could prove costly in terms of investing miscues.

Let's look at the 3 common investing mistakes to avoid to safeguard your investments and prevent unnecessary stress:

1. TRYING TO TIME THE MARKET

Navigating Market Timing Temptations: The Risks of Predicting Downturns and Missing Opportunities

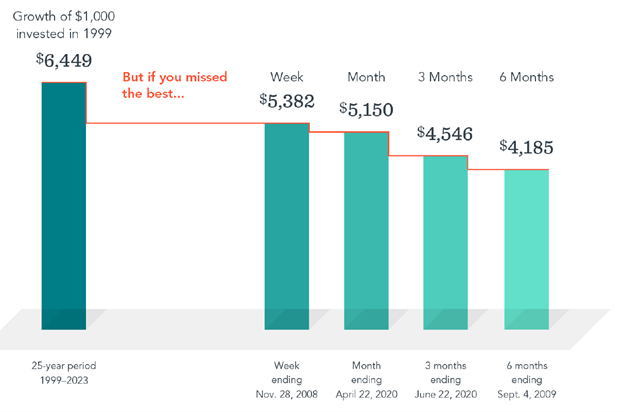

Investors may be tempted to cash out of the stock market to avoid a predicted downturn. However, accurately forecasting the market’s direction when buying and selling is a guessing game. Missing only a brief period of strong market performance can drastically affect your lifetime wealth.

For example, the chart below shows a hypothetical investment in the Russell 3000 Index, a broad US stock market benchmark. Over the entire 25-year period ending December 31, 2023, a $1,000 investment in 1999 turned into $6,449. But what if you pulled your cash out at the wrong time? Missing the best week, month, three months, or six months would have significantly reduced the growth of your investment.

The Cost of Missing the Best Consecutive Days

Russell 3000 Index total return, 1999-2023

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Rather than trying to predict when stocks will rise and fall, investors can hold a globally diversified portfolio—and by staying invested, be better positioned to capture returns whenever and wherever they occur.

2. FOCUSING ON THE HEADLINES

Chasing the Magnificent 7: The Pitfalls of Over-Concentration in Popular Stocks

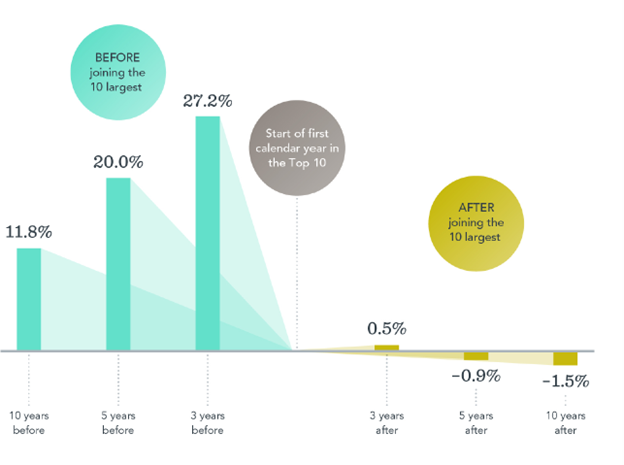

Investors may become enamored with popular stocks based on recent performance or media attention—and over concentrate their portfolio holdings in these companies. One example is the rise of the large US technology companies known as the Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla).

But in chart 2 below, we see that many fast-growing stocks have stopped outperforming after becoming one of the ten most extensive stocks in the US. On average, companies that outperformed the market on the way up failed to outperform in the years after making the Top 10 list.

Stocks on the Way Up, and After Average annualized outperformance of companies before and after the year they became one of the 10 largest in the US, 1927-2023

Past performance is no guarantee of future results. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security.

The lesson? Rather than loading up on a handful of stocks that have dominated the market, you can own many stocks through mutual funds or ETFs. Diversifying across industries and global markets can help reduce overall risk and position investors to potentially capture the returns of future top-performing companies.

3. CHASING PAST PERFORMANCE

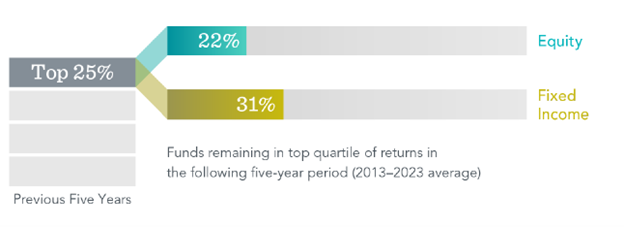

Beyond the Hype: Why Relying on Past Performance for Investment Decisions May be Misleading

You may select investments based on past returns, expecting top-ranked funds to continue delivering the best performance. But can they maintain that outperformance? Research shows that most funds ranked in the top 25% based on five-year returns didn’t remain in the top 25% in the next five years. Only about one in five equity funds stayed in the top-performing group, and only about a third of fixed-income funds did.

Percentage of Top-Ranked Funds that Stayed on Top

Past performance is no guarantee of future results.

The lesson? A fund’s past performance offers limited insight into its future returns.

At Complete View Financial, we are committed to providing you with personalized guidance and expertise to navigate the complexities of the market. Whether you're a seasoned investor or just starting your financial journey, we are here to provide investment education that fits your situation.

Let’s resist the temptation to chase the golden egg of instant success. Instead, focus on steadily filling your investment basket one egg at a time, guided by strategic insights and expert advice.