Currency Hedging? Consider The Asset Class

January 27, 2026 Author: Tess Downing, MBA, CFP®, Complete View Financial

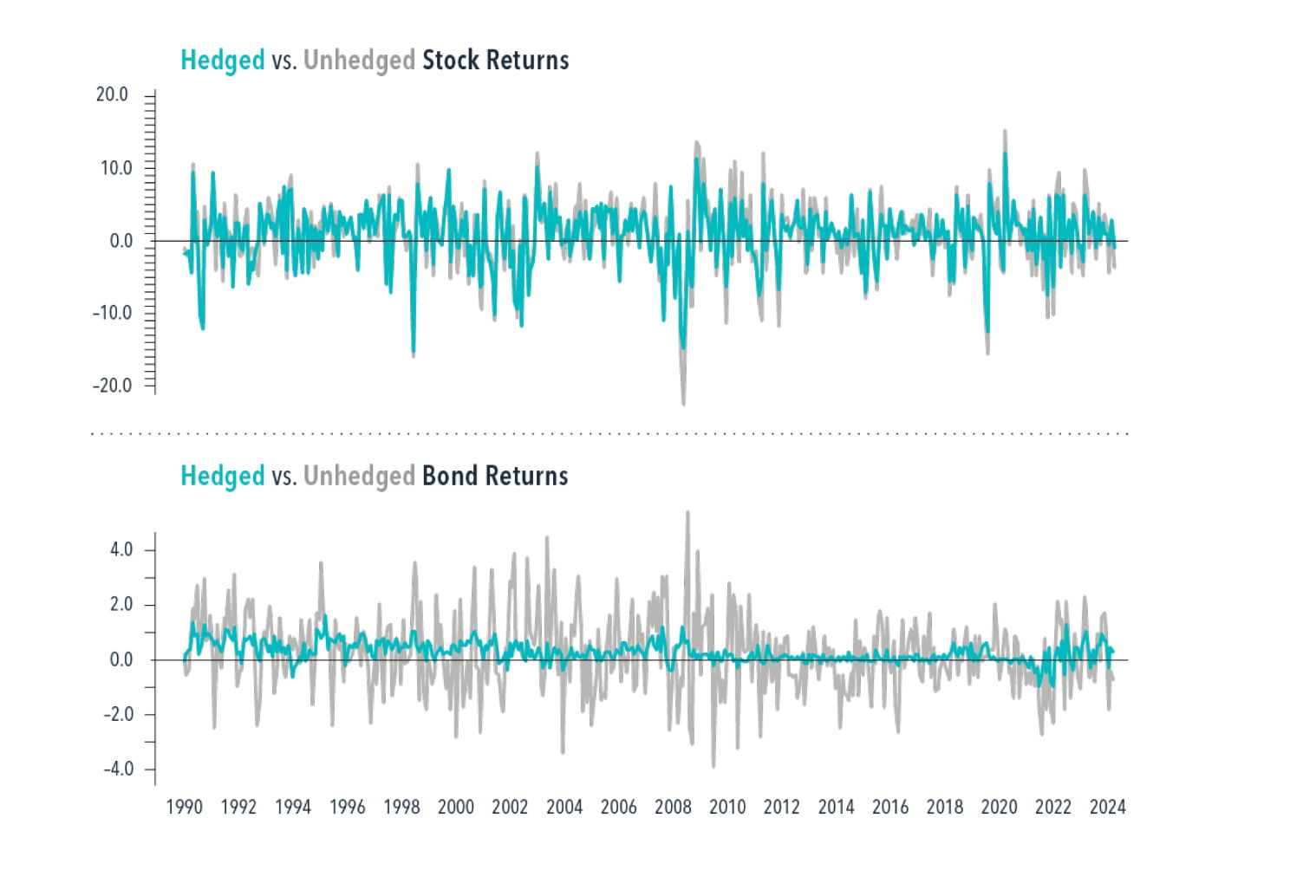

Currency movements can influence returns on international investments, but whether to hedge that exposure depends on the asset class. For global equities, most volatility comes from stock price movements rather than currency shifts, meaning hedging typically provides little additional stability. Global bonds, on the other hand, are naturally less volatile, so currency swings have a bigger impact. In this case, hedging can meaningfully reduce volatility and help maintain the steadiness investors expect from their bond allocations.

The Bottom Line:

Hedging isn’t about doing it everywhere; it’s about doing it where it matters. Currency hedging tends to add the most value in global bonds, while equity investors can often stay unhedged without increasing overall portfolio risk.

Impact of Currency Hedging on Return Volatility: 1990–2024 (Dimensional Fund Advisors)