Diversification vs Concentration

June 25, 2024 Author: Tess Downing, MBA, CFP®, Complete View Financial

This month we explore the topic of diversification vs. concentration when building investment portfolios. When I was considering this topic, I was reminded of the famous quote by Nobel laureate, Harry Markowitz, that stated "Diversification is the only free lunch in investing."

While most people understand the basic concepts of diversification, most portfolios do not reflect the principles of diversification. This article aims to highlight the benefits of diversification as well as the hurdles many investors face when implementing a truly diversified portfolio.

Diversification is the practice of spreading investments across a variety of assets. It’s a time-tested strategy to mitigate risk. Children learn about it early in life with the phrase “Don’t put all your eggs in one basket." While the allure of concentrated stock positions may promise quick gains, the benefits of diversification offer a resilient shield against market volatility and potential losses.

The rationale behind diversification lies in the fact that different assets perform differently under various market conditions. While one asset may falter, another could thrive, balancing out the overall performance of the portfolio.

One of the primary advantages of diversification is risk reduction. Concentrating investments in a single stock can expose investors to significant risk if the company faces challenges such as poor performance, regulatory issues, or market downturns. A sudden decline in the stock price of a single company could result in substantial losses for an investor with a concentrated position. Diversification spreads this risk across multiple investments, cushioning the impact of any individual asset's underperformance.

Whether investors understand the risks of holding a concentrated position or not, there is a tendency to hold onto these positions. Corporate executives may face insider selling constraints or concerns about how a sale would affect the market price of their company’s stock. Other investors simply have an emotional attachment to the stock. Many investors are concerned about the tax implications of selling.

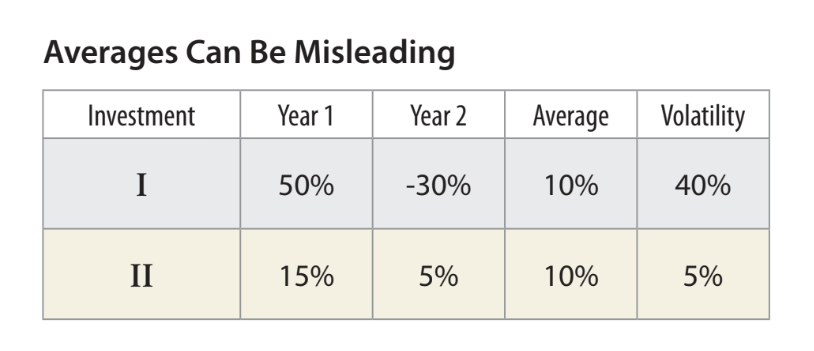

So why does a diversified portfolio often outperform a single stock position? The answer lies in the lower volatility. Greater volatility in a portfolio reduces compounded growth rates and future wealth. The example in the tables below illustrates this point through two hypothetical investments that generate the same average annual return of 10%, but with varying levels of volatility. In Table A, Investment I averages a 10% return but is the more volatile investment, increasing 50% one year and decreasing 30% the next. Investment II also averages a 10% return; however, it is less volatile, up 15% and 5% in the two years, respectively.

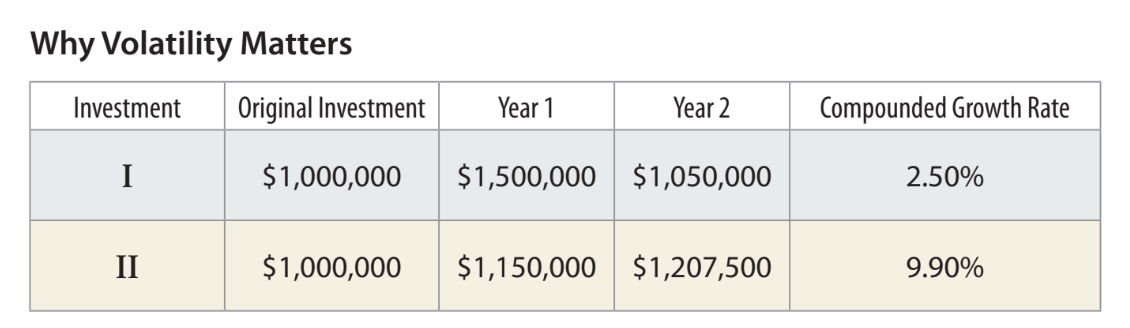

As Table B shows, Investment II, the less volatile of the investments, generates a much higher compounded growth rate of 9.9%, compared with 2.5% for Investment I. As a result, a $1,000,000 investment in Investment II grows to $1,207,500 in two years. That’s over $150,000 more than Investment I simply because of the investment’s lower volatility. In summary, the more an investment’s return fluctuates year by year (i.e., the higher the volatility), the greater the drag on the compounded growth rate and the lower the future wealth. Thus, controlling volatility and risk through proper diversification does matter in portfolio management.

While concentrated stock positions may hold the promise of outsized gains, they also come with significant risks. Diversification, on the other hand, offers a time-tested strategy for safeguarding investments and optimizing returns. By spreading investments across different assets, investors can mitigate risk, smooth out volatility, and maximize long-term sustainability. In an ever-changing and unpredictable market environment, diversification remains a cornerstone of prudent investing, providing a solid foundation for building and preserving wealth.

Baird (2016) Whitepaper: The Hidden Cost of Holding a Concentrated Position: Why diversification can help to protect wealth, By Baird’s Private Wealth Management Research