How Much Impact Does the President Have on Stocks?

October 25, 2024 Author: Tess Downing, MBA, CFP®, Complete View Financial

As Election Day in the U.S. approaches, speculation on market outcomes begins to ramp up. Financial circles are buzzing with opinions and predictions, but should elections really influence your long-term investment decisions?

We advise caution. Making changes to a long-term plan in anticipation of election outcomes can be risky. Markets, driven by millions of investors and billions of dollars trading daily, are highly efficient at processing information. This means that trying to consistently outguess market prices is exceedingly difficult.

Looking at data since 1926, stock market returns during presidential election months are not substantially different from returns in any other month. In fact, the wide range of election month returns suggests no clear pattern based on which party wins the presidency. Whether red or blue, election results have not reliably predicted market performance.

It’s natural to search for a connection between who wins the White House and which way stocks will go, but it’s important to remember: shareholders are investing in companies, not a political party. Companies continue focusing on serving their customers and growing their businesses, regardless of who occupies the Oval Office.

What Can History Teach Us?

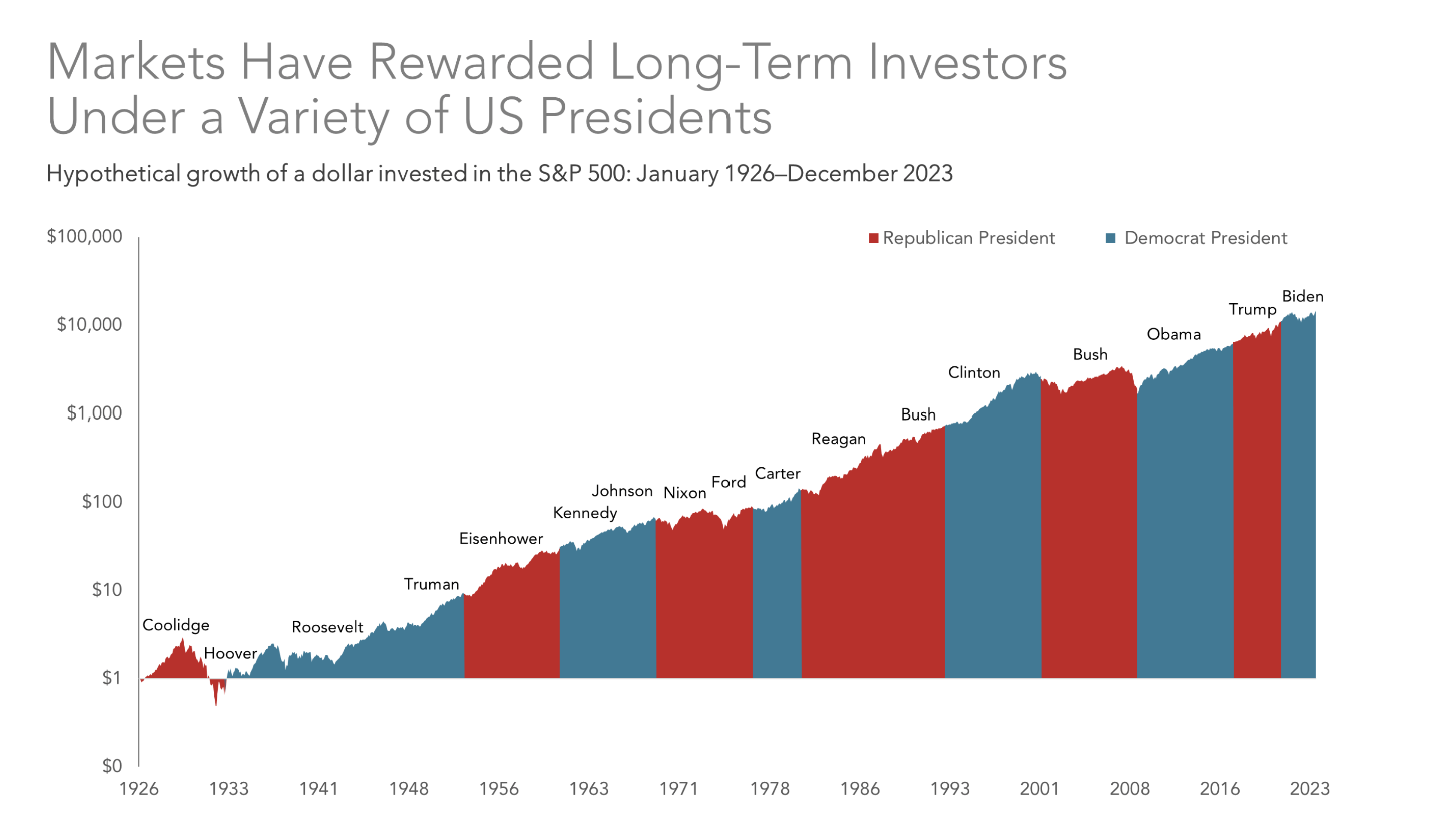

Stocks have rewarded disciplined investors over the long term—through both Democratic and Republican presidencies. Making investment decisions based on election outcomes, or attempting to anticipate them, is unlikely to generate consistent excess returns. On the contrary, it may lead to costly mistakes.

The lesson? Stick to a long-term, diversified approach. Presidents may influence markets, but so do a host of other factors—interest rates, global politics, oil prices, and technological advancements, just to name a few. Over time, the markets have tended to rise, regardless of who is in the White House.

Exhibit: Markets Have Rewarded Long- Term Investors Under a Variety of US Presidents shows the frequency of monthly returns (expressed in 1% increments) for a broad-market index of US stocks from January 1926–June 2020.

What History Tells Us About Elections and the Market

If you'd like to dive deeper into this topic, click the link below to watch a 5-minute video that addresses some common questions and provides further insights on the current political climate. A reminder worth hearing every four years: ‘Markets tend to reward long-term investors regardless of who wins the presidential election', by Dimensional.

How do elections affect the economy and my portfolio?

It's challenging to draw a definitive conclusion. Many factors influence stock prices, and it's hard to pinpoint the impact of a specific president or political party.

Is there a pattern in market returns based on presidential terms?

No clear pattern exists. Stock prices are impacted by a multitude of factors—interest rates, oil prices, global events—not just elections.

Should I adjust my investments based on political outcomes?

Regardless of which party is in power, focusing on the long-term growth of capital markets is a wise strategy.