How to Be Prepared for Tax Season

March 25, 2024 Author: Tess Downing, MBA, CFP®, Complete View Financial

How to Be Prepared for Tax Season

Tax season can be daunting, but you can confidently tackle it with proper preparation. Planning is crucial whether you're a seasoned tax filer or newly retired. Here are some steps to help you prepare:

Step 1: Find your Forms

Gather all the necessary forms to complete your tax return, including W-2, SSA-1099, 1099, 1095-A, 1098, W-2G, and K-1s. Check for accuracy and completeness.

Step 2: Retrieve your Receipts

Record your expenses, especially if you plan to itemize deductions. Retrieve receipts for medical expenses, charitable contributions, and other deductible items.

Step 3: Charitable Contributions

Compile information on any charitable donations made throughout the year for potential deductions.

Step 4: List your Personal Information

Ensure you have your social security number, dependent details, and property addresses for accurate reporting.

Step 5: Get a Copy of Last Year’s Tax Return

Referencing your previous year's tax return can provide valuable insights and ensure consistency in filings.

Step 6: Remember to Review Your 2023 Tax Return

It is important to review your tax returns now because there is still time to address issues before officially filing.

Reviewing tax returns can be confusing and difficult given the many state and federal complexities and often changing rules. Tracking your exposure to various taxes (e.g., ordinary income tax, capital gains tax, the alternative minimum tax, the net investment income tax, etc.), and your rights to various credits and deductions are important to ensuring you are filing correctly. Here is a short list of important considerations:

- Did you make a withdrawal from your IRA? Are you RMD age? Review your 1099-R provided by your custodian.

- Did you make a non-deductible IRA contribution? Make sure the cost basis is being reported on Form 8606.

- Did you convert dollars to a Roth IRA? Make sure to report the basis correctly.

- Did you have ESPP or RSUs this year? Make sure to use the Supplemental Tax Form provided by the custodian to ensure you are not overpaying your taxes.

- Did you roll over retirement funds during this tax year? (401k to IRA) Review your 1099-R to ensure the code reflects $0 taxable distribution.

- Will you need to establish estimated quarterly tax payments?

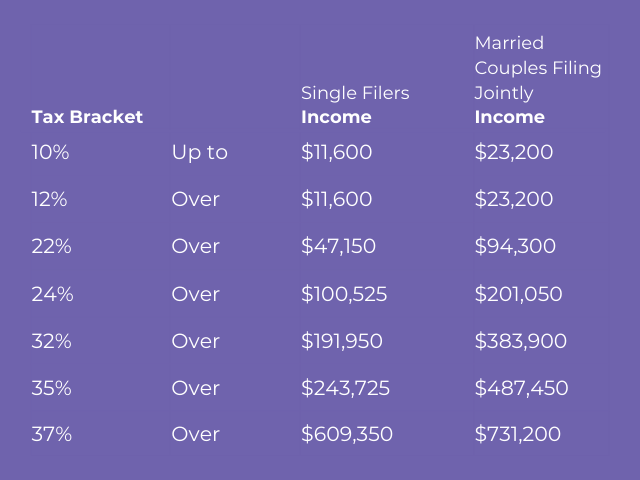

Planning a Multi-Year Strategy with Tax Brackets

Tax brackets are tied to inflation and are meant to reflect real income levels. Here are some of the changes taking effect in 2024:

2024 Tax Brackets

Standard Deduction Increases

The federal standard deduction for single filers will increase to $14,600 in 2024. For married couples filing jointly, the amount is $29,200. When considering itemizing, compare your charitable contributions, mortgage interest, and the allowable amount of local taxes to the standard deduction value. If that value is greater than the standard deduction, it may be smarter to itemize.

Retirement and Healthcare

The new maximum contribution limit for 401(k) savings has increased to $23,000. If you are 50 or over, you can utilize “catch-up” contributions of $7,500, which could put you at $30,500. These new limits also lower your taxable income.

IRA and flexible health spending accounts have increased their contribution limits as well. For IRA, the limit is now $7,000, with $1,000 added for those 50+ with catch-up. For flexible health spending, contributions can now be up to $3,200 of pre-tax dollars to help pay for medical costs that insurance doesn’t cover.

Health Savings Accounts (HSA) also have new maximum contributions. The family contribution has increased to $8,300, with individual contributions rising to $4,150. Catch-up amounts stay at $1,000 for those aged 50 and older.

Social Security Benefits, Earnings Test, and Tax Increases

2024 social security benefits increased by 3.2%, and the maximum monthly benefit for claiming at your full retirement age (FRA) will be $3,822. Your earnings will have an earnings test limit if you work while collecting social security. If they exceed this amount, benefits are reduced by $1 for every $2 you are over the limit. For people attaining this after 2024, the annual exempt amount in 2024 is $22,320. The annual exemption amount for people who achieve this in 2024 is $59,520.