How Will the Oil Market Affect Your Retirement Savings?

April 29, 2020 Author: Tess Downing, MBA, CFP®, Complete View Financial

Last week, oil prices (adjusted for inflation) reached an all-time low and, in fact, for the first time ever, a negative oil contract was effectively sold. As one of the world’s most important commodities, for better or for worse, the oil market plays a crucial role in the global economy and the American economy in particular.

There are quite a few reasons why oil experienced such a dramatic price drop. In addition to the COVID-19 outbreak triggering a major decrease in global demand, tensions between Iran, Saudi Arabia, Russia, and other countries has resulted in a global supply glut.

If you’ve gone to the pump recently, you’ve probably noticed that gas prices are much lower than usual—in this sense, low oil prices can be good for the average consumer. Your monthly energy bills may have been lowering than usual, as well. However, as an investor, you might also be worried about the impact that low oil prices have on your long-term saving strategies.

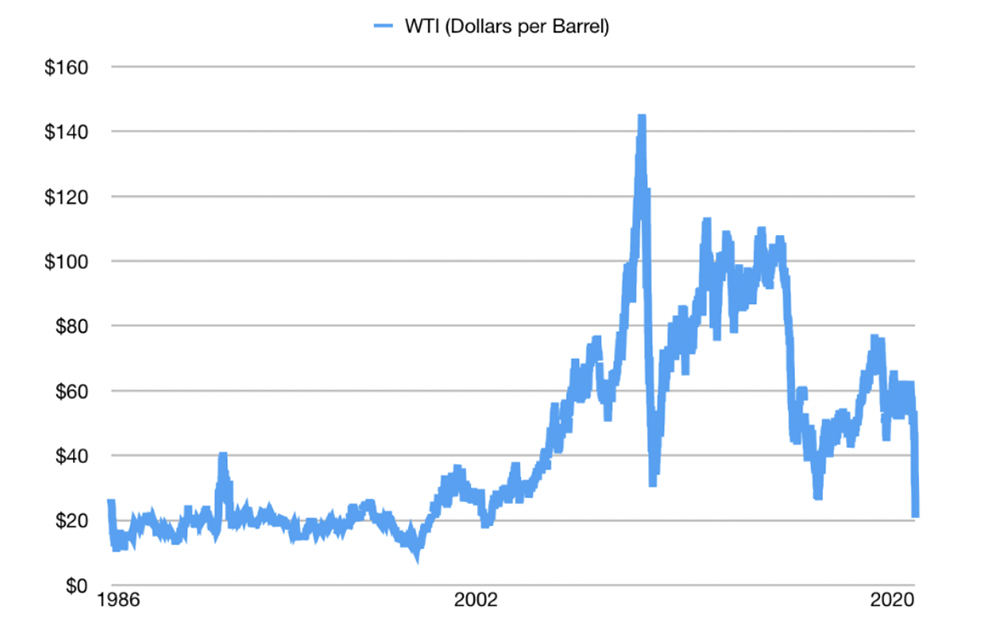

Image: In early 2020, Oil Prices have experienced a very sharp and sudden decline. Source: Baton Rouge Business Report.

The Pros and Cons of Low Oil Prices

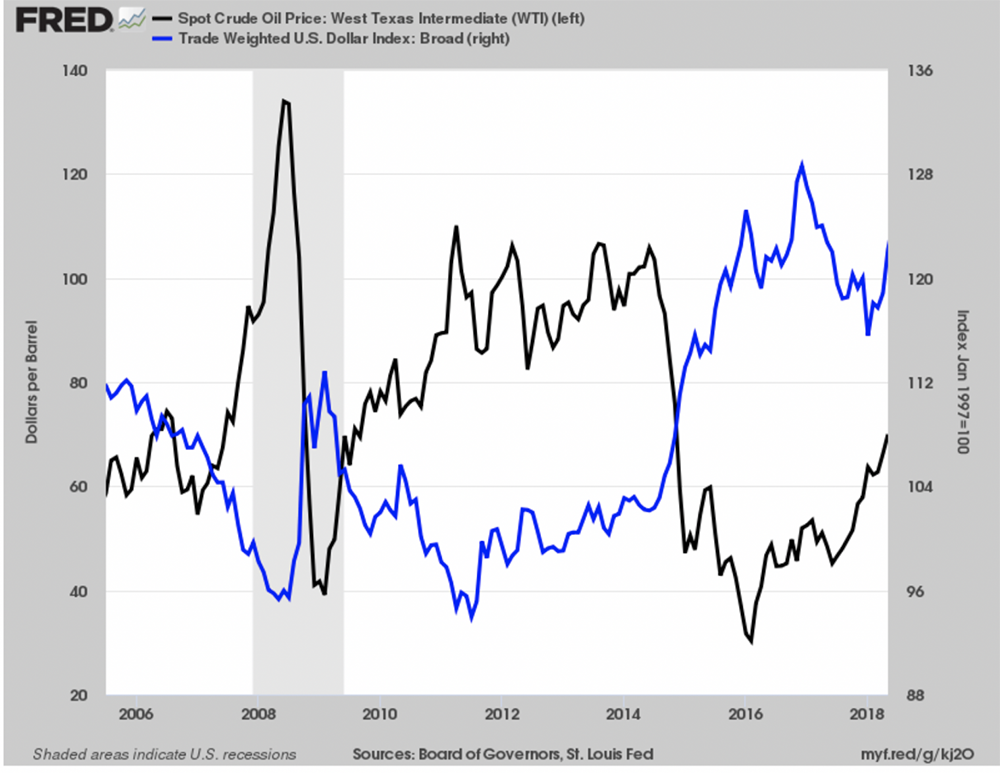

In many parts of the world, including the United States and Saudi Arabia, oil contracts can only be purchased using the American Dollar (USD). This is sometimes referred to as the “Petro Dollar” system. Because of this, the relationship between oil prices and the value of the dollar is exceptionally strong. When oil prices are extremely low, the dollar can acquire more barrels of oil, meaning that—relatively speaking—low oil prices cause the American Dollar to be more valuable.

However, oil prices are also strongly tied to the American economy. Many of the nation’s largest companies, including ExxonMobil and Chevron, are in the oil industry. When these companies experience stock declines, it not only affects their performance—it affects the performance of many other stocks and stock indexes as well.

As you can see, dropping oil prices creates a bit of a mixed bag for many Americans: while the Dollar’s value increases and many products become cheaper, they are also seeing some losses in the 401k and other savings vehicles.

Image: as we can see, the cost of oil and the value of the dollar have historically had an inverse relationship.

So, moving forward, what is the best investment strategy?

Because the underlying causes of this price drop are largely temporary, we know that oil (and oil producers) is likely undervalued in the status quo. The dollar is also more powerful than usual—at least for the time being. While this may seem counterintuitive, these trends create the perfect situation for investing in undervalued oil stocks and indexes and waiting for the stocks to return to their “normal” values in the near future.