Investing Can Be a Roller Coaster

April 25, 2025 Author: Tess Downing, MBA, CFP®, Complete View Financial

When markets are volatile, it’s easy to let emotions take over. But successful investing isn’t about reacting to every twist and turn—it’s about maintaining perspective and staying committed to your long-term goals.

Here are three key strategies to help you ride out the market’s highs and lows:

1. Keep Your Eye on the Horizon

- Market declines are a normal part of investing, but history shows that the market generally trends upward over time.

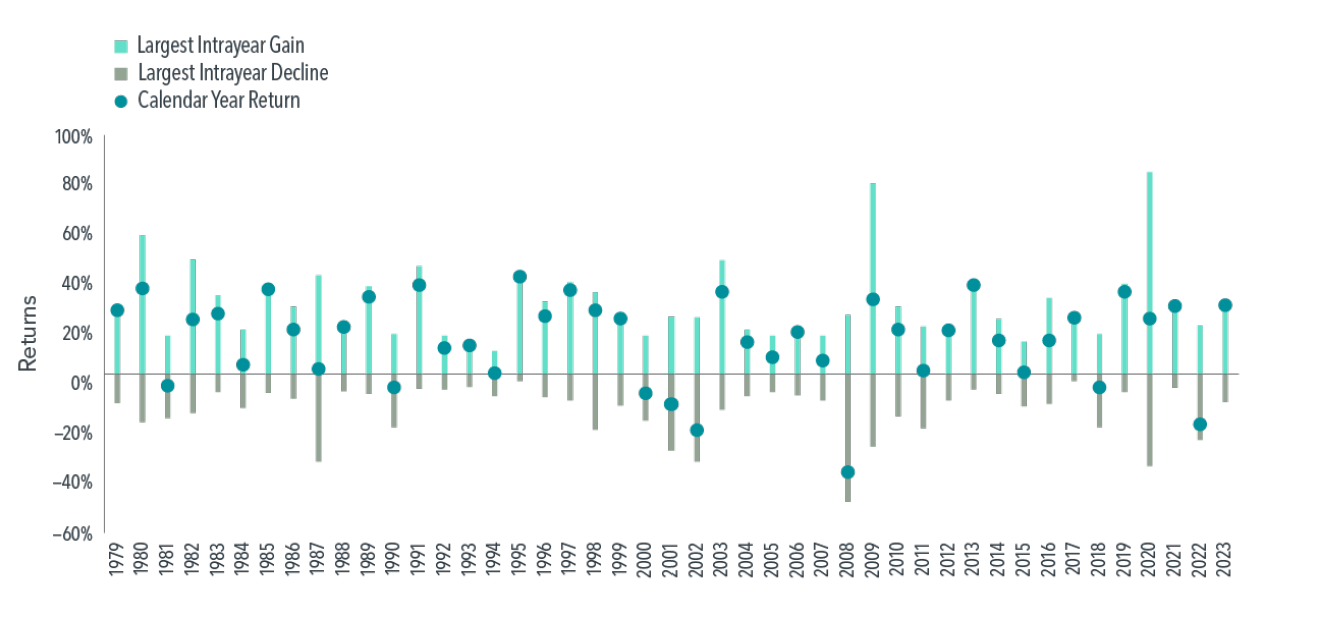

- Since 1979, the U.S. stock market has had an average intrayear decline of -14%, yet 37 out of 45 calendar years still ended with positive returns.

- Instead of panicking over short-term volatility, focus on long-term growth potential.

US Market Intrayear Gains and Declines vs. Calendar Year Returns 1979–2023

Source: Dimensional Fund Advisors

2. Stay in Your Seat

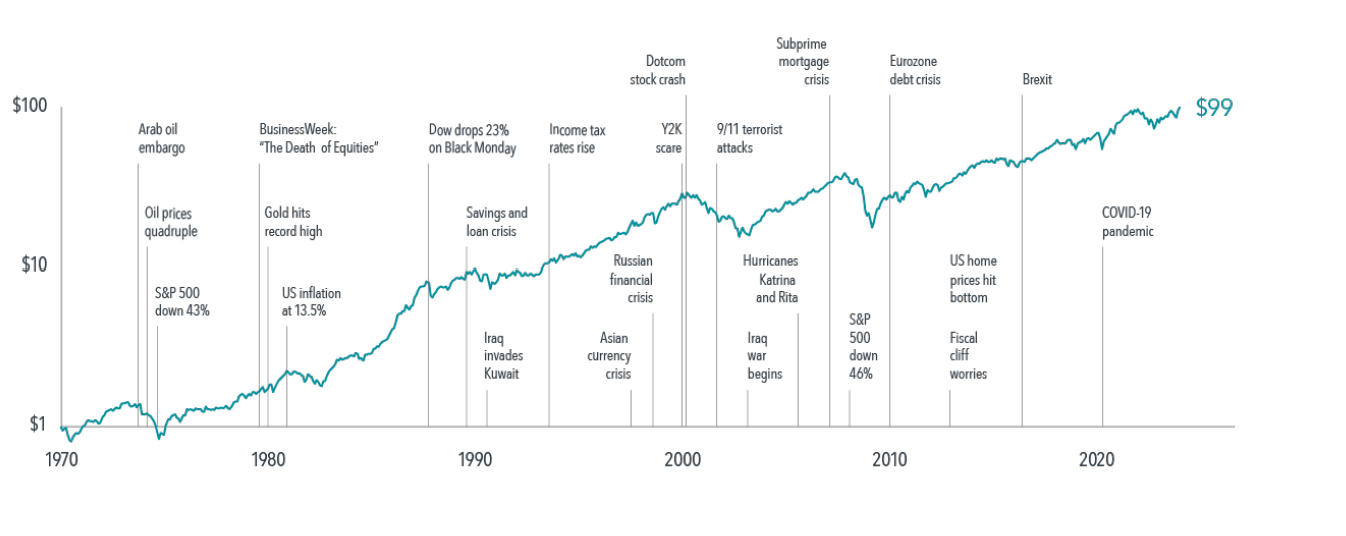

- Reacting to market swings by frequently buying and selling can hurt long-term returns.

- Trying to time the market increases the risk of missing the best-performing days:

- A $1,000 investment in the S&P 500 from 1990 to 2023 would have grown to $27,221 if left untouched.

- Missing just one of the best-performing days could reduce that amount by nearly $3,000.

- Missing five of the best days could lower it by more than $10,000.

- Staying invested, even during downturns, is key to long-term success.

Growth of a Dollar—MSCI World Index (Net Dividends) 1970–2023

Source: Dimensional Fund Advisors

3. Know Your Thrill Tolerance

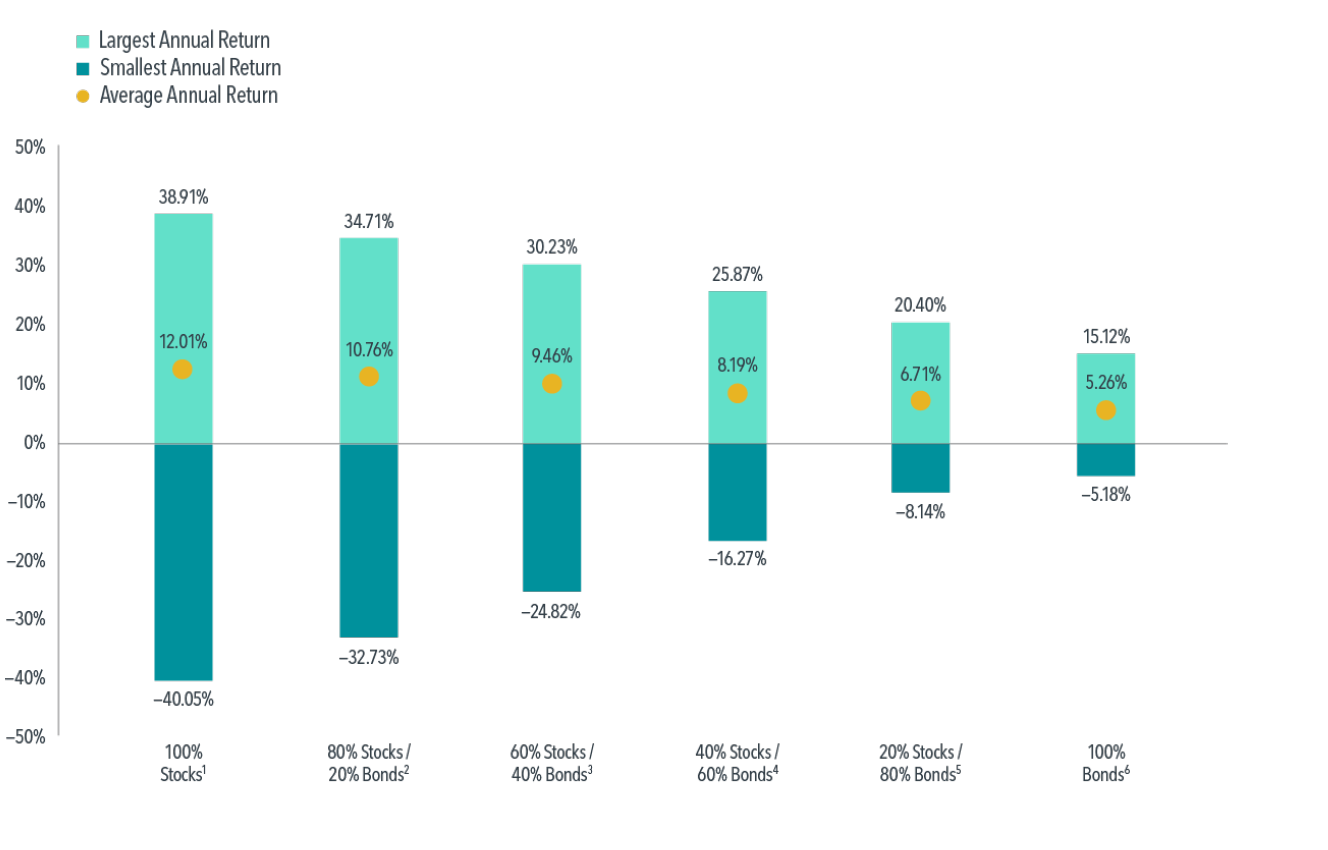

- Just like roller coaster riders choose rides based on their thrill tolerance, investors should align their portfolios with their risk tolerance.

- A well-balanced, diversified portfolio can help mitigate risk and provide a smoother investment experience.

Stock-Bond Asset Allocation Performance 1985–2023

Source: Dimensional Fund Advisors

By keeping a long-term perspective, avoiding impulsive decisions, and ensuring your investments align with your personal risk tolerance, you can navigate the market’s ups and downs with confidence.

Tariff Trepidation: How Trade Policies Impact Markets

Trade policies and tariffs play a significant role in shaping market conditions, influencing everything from corporate earnings to consumer prices. Tariff Trepidation explores how recent tariff decisions have impacted different sectors, creating volatility and uncertainty for investors. While tariffs can disrupt supply chains and economic growth in the short term, markets tend to adapt over time. Understanding these dynamics can help investors make informed decisions and avoid reactive, short-term moves.

1. The Immediate Impact of Tariffs

- Tariffs can increase costs for businesses that rely on imported goods, squeezing profit margins.

- Consumers often face higher prices as companies pass along increased costs.

- Trade tensions can lead to market volatility as investors react to policy changes and geopolitical uncertainty.

2. Market Adaptation Over Time

- Historically, markets have shown resilience, adjusting to new trade environments through shifts in supply chains and business strategies.

- Companies often respond by sourcing materials from different countries or renegotiating trade agreements.

- Investors who stay diversified and avoid knee-jerk reactions to trade news tend to fare better in the long run.

3. What Investors Can Do

- Stay diversified: A well-balanced portfolio can help mitigate the risks of sector-specific tariff impacts.

- Focus on long-term fundamentals: While tariffs create short-term disruptions, broader economic trends often outweigh temporary policy shifts.

- Keep an eye on global trade developments: Understanding trade relationships and policy trends can provide insight into potential market movements.

While trade disputes and tariffs can introduce uncertainty, history shows that markets adjust. Investors who maintain a steady, long-term perspective can navigate these challenges with confidence.