Is Dividend-Only Stock Investing A Reliable Strategy?

May 22, 2023 Author: Tess Downing, MBA, CFP®, Complete View Financial

A question I frequently receive from individual investors relates to owning dividend stocks to generate income during their retirement years. While this strategy may have been praised by industry experts at one point in time and even today, the data and evidence over the past several decades have shown that there are significant tradeoffs that investors should be aware of when focusing on investing only in firms that pay dividends.

Dividend-paying stocks are sometimes seen as a ballast to a portfolio, particularly during periods of volatility, due to their ‘regular’ income stream. However, companies paying dividends have the flexibility to cut their dividends, which often coincides with economic downturns. In fact, more than half of dividend-paying firms cut or eliminated those payouts following a financial crisis1. More recently, in the first three quarters of 2020, dividends from each dollar invested in US markets decreased by 22% compared to the same period in 2019.

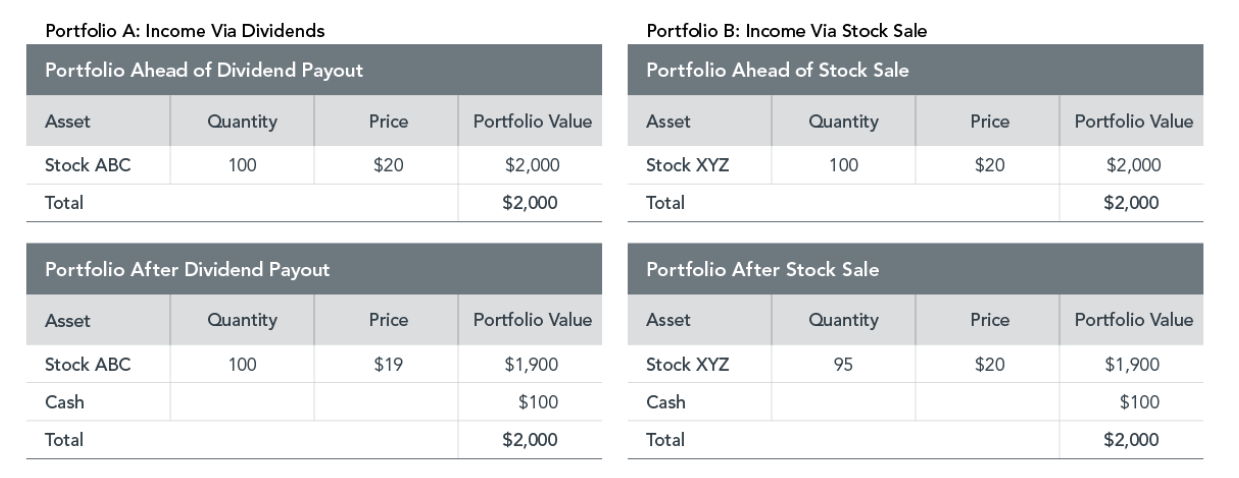

For stockholders who own dividend-paying shares, those payments arrive on a schedule (quarterly, in many cases). The cash to fund a dividend must come from somewhere, however. We know the price of a stock is potentially influenced by all expected future cash flows to shareholders. If cash is paid today in the form of a dividend, the stock price—and total market capitalization—of the issuing company may therefore fall, as hypothetical Portfolio A shows in Exhibit 1 below. That means, all else being equal, an investor who receives a dividend may also be left with a less valuable equity holding.

Exhibit 1

For illustrative purposes only. Assumes the stock price will fall by roughly the amount of the dividend and assumes no non-dividend-related price movement.

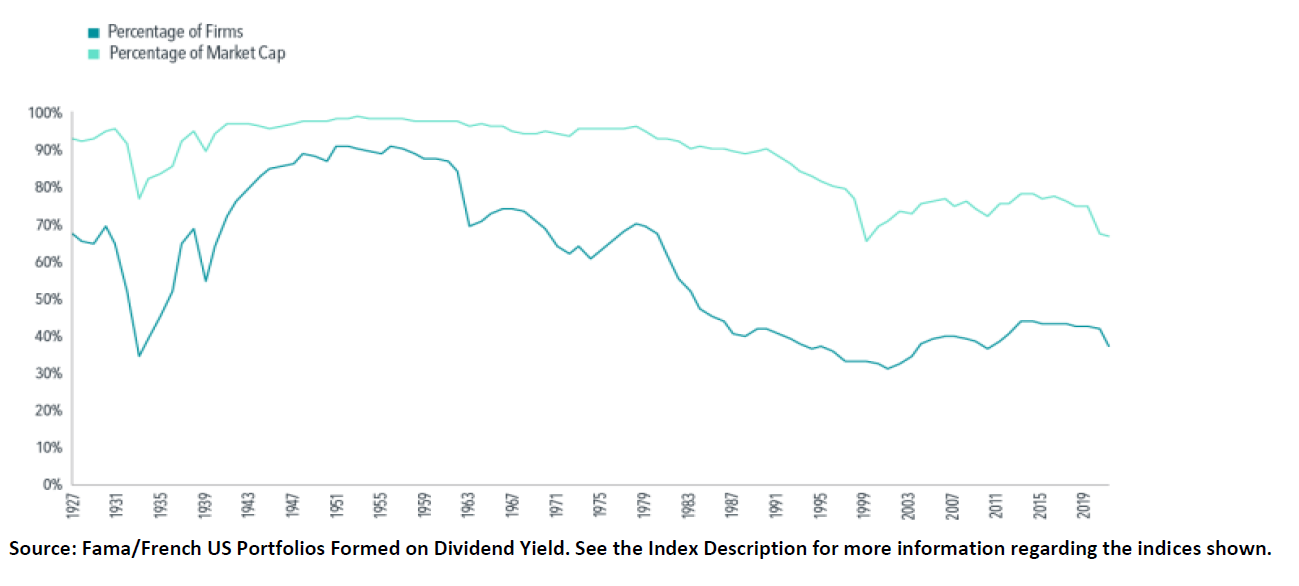

It's also important to note that by focusing on only dividend-paying stocks, an investor would be excluding 35-40% of firms from their investable universe3. This choice directly affects the total portfolio’s level of diversification. Over the years, we have seen a global decline in the propensity of firms to pay stock dividends out to shareholders. For instance, in 1927, 68% of US companies were paying dividends, while only 38% of firms paid in 2021 as can be seen in Exhibit 2 below.

Exhibit 2: Annual percentage of firms and a market cap that paid dividends in the United States

1921 -2021

While we cannot predict what the investing landscape will look like in the future, we can certainly lean on the historical data and trends within the investible dividend universe to make informed asset allocation decisions.

1: Stanley Black, “Global Dividend-Paying Stocks: A Recent History” (white paper, Dimensional Fund Advisors, March 2013). 2: “Dividends in the Time of COVID-19,” Insights (blog), Dimensional Fund Advisors, November 30, 2020

3: Data provided by Bloomberg. The countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the Netherlands, the United Kingdom, and the United States

4: Source: Fama/French US Portfolios Formed on Dividend Yield. See the Index Description for more information regarding the indices shown. Provided by Fama/French from CRSP and COMPUSTAT data. Includes all NYSE, AMEX, and NASDAQ stocks for which we have market equity for June of year t, and at least 7 monthly returns (to compute the dividend yield) from July of t-1 to June of t. Portfolios are formed on D/P at the end of each June using NYSE breakpoints. The dividend yield used to form portfolios in June of year t is the total dividends paid from July of t-1 to June of t per dollar of equity in June of t.