Keep Your Investment Appetite in Check

December 25, 2025 Author: Tess Downing, MBA, CFP®, Complete View Financial

Market downturns can stir up emotions—hesitation, fear, or the urge to “wait it out” in cash. But history reminds us that our appetite for risk is often lowest when the opportunity for long-term growth is highest.

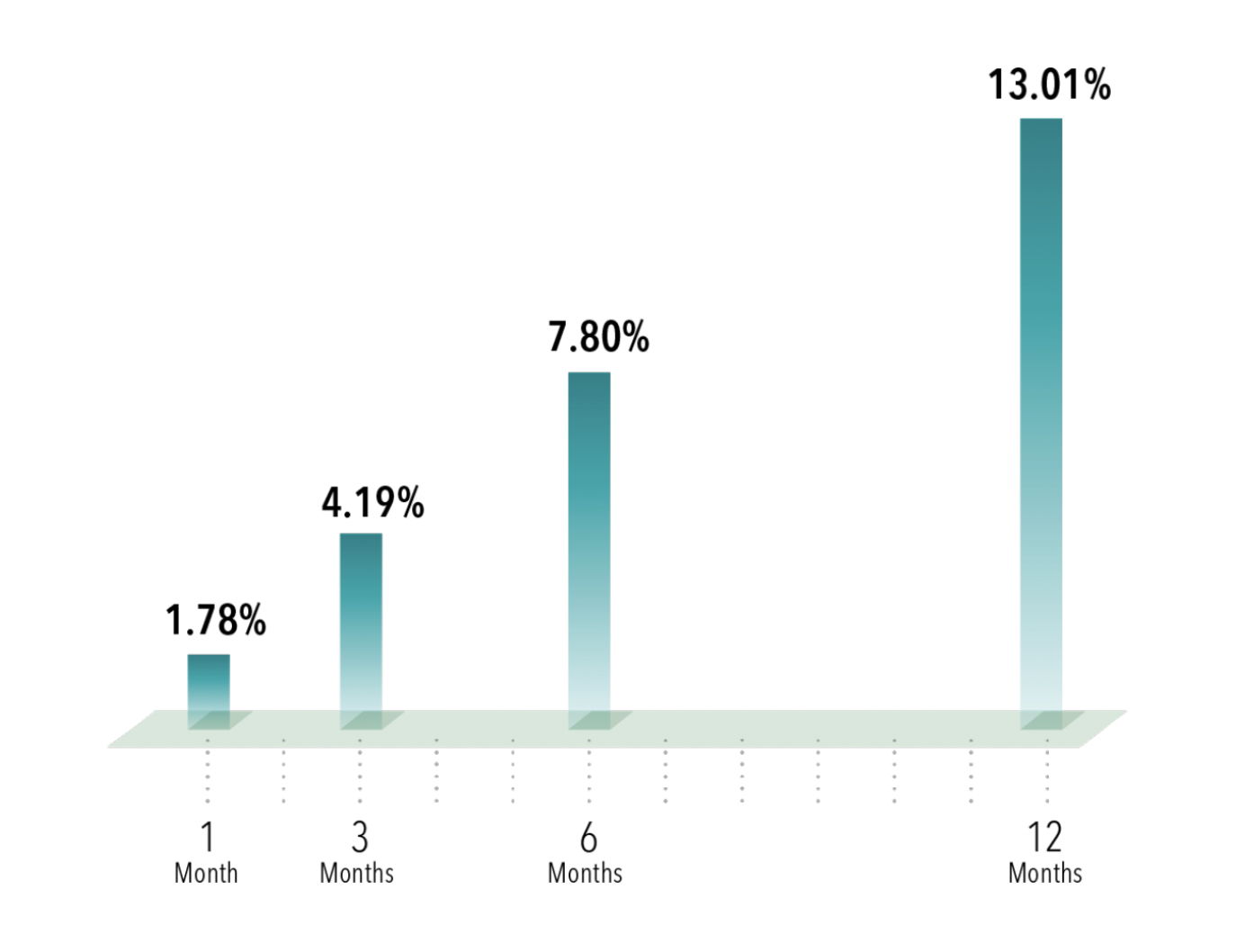

DFA’s research shows that a balanced 60/40 portfolio has historically outpaced cash in the months following sharp market declines. The temptation to retreat may feel comforting, but doing so often means missing the rebound. Just as a hot-air balloon lifts above shifting winds, staying invested allows you to rise above short-term turbulence and maintain perspective.

Appetite for Destruction: Average relative outperformance of a 60/40 portfolio vs. a cash allocation following a 3-month US stock market decline of 10% or more, February 1982–June 2025 (Dimensional Fund Advisors)

The Bottom Line:

Staying invested—aligned to your long-term strategy—has been far more beneficial than reacting to short-term discomfort. This month is a good time to revisit your plan, ensure it reflects your goals, and remind yourself that discipline is a powerful driver of long-term results.