Safeguarding and Passing On Your Digital Assets

May 3, 2022 Author: Tess Downing, MBA, CFP®, Complete View Financial

As cryptocurrency becomes a more significant part of the financial ecosystem, it’s essential to ensure that the assets are safely and appropriately stored and that you have a plan for the eventual transfer of them. But you need to be aware, this process doesn’t work the same way as for traditional assets.

Taking Careful Inventory

One of the first steps to safeguarding your digital assets is taking inventory of what you have. With how many ways there are to purchase and store crypto, it’s easy to forget where all of them are located and since the space is still new, there isn’t really an easy way to keep track of them.

Taking inventory looks different for everyone, but one of the most common ways is using a simple Excel or Google spreadsheet. You would want to include a few things: the name of the asset (bitcoin, ether, etc.), how much of it you own, your original purchase price(s), and where it’s located. This information will help you keep everything in order and makes the information easily accessible for when tax time rolls around.

There is software out there, such as CoinTracker, that can help keep track of your digital assets, but not every software integrates well with others. Right now, it may be easiest to keep it simple and stick to manual input until more sophisticated solutions exist.

Storing Crypto in Your (Digital) Wallet

There are two different kinds of wallets. Hot wallets (also known as ‘soft’ wallets) live online and are usually an extension in your web browser or an app. These would be brands such as MetaMask, Rainbow, or Strike. The other kind is a cold wallet (also known as a ‘hard’ wallet). These exist offline and are like a USB drive. A hard wallet plugs into your computer and because it’s not always connected to the internet, it’s generally considered to be more secure than a soft wallet. Some common hard wallet providers are Ledger and Trezor.

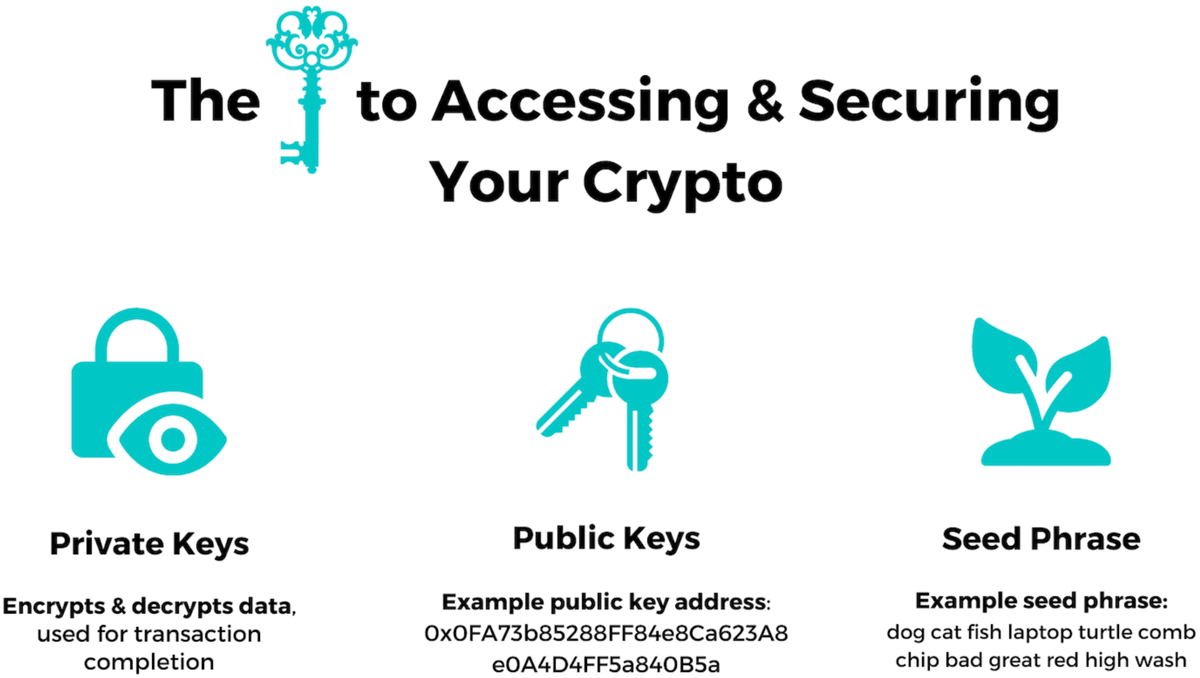

Public keys

Every wallet comes with a set of private and public keys and a seed phrase. Wallet keys are a long string of random numbers and letters assigned to your wallet, and your public keys are like your home address. Just like how you would give out your address to someone if they wanted to send you a package, you give out your public address if someone wants to send you crypto.

Private keys

Your private keys are like the keys that unlock your home. You never give them out to anyone, and their primary purpose is to allow you to complete a transaction. So, if someone had both your public and private keys, they could drain your wallet of all funds.

Seed phrase

Finally, your seed phrase is a 12-word phrase generated from the private keys to make it easier to remember, and its purpose is to serve as a backup if you were to misplace or forget your wallet credentials. If you have the seed phrase but lost the keys, all the assets in that wallet can typically be restored.

Custodial wallets

With both hot and cold wallets, you’re in control of the private and public keys, giving you full access to the funds. This is important to note because custodial wallets do not grant that same ability.

Custodial wallets are provided by exchanges, such as Gemini and Coinbase, and the greatest distinction between custodial wallets and non-custodial wallets is that with custodial wallets, you generally do not have access to the private keys. The exchange does not disclose them, and because of this, some investors prefer not to store large amounts of crypto on their custodial wallet after purchasing.

Using a custodial wallet comes with less responsibility than a non-custodial wallet, but the tradeoff here is security. With a custodial wallet, in the event of a hack or data breach of the custodian, your crypto would be unsecured and vulnerable. With non-custodial wallets, you’re the only one who controls access to the private keys and data. However, one positive attribute that custodial wallets hold over non-custodial wallets is that cash held in them is generally FDIC insured up to $250,000.

Whatever route you decide to take with wallets and storage, the main thing to remember is never to give out your private keys or seed phrase. Doing this can make all the cryptocurrency you hold in that wallet accessible to whoever you give them to.

Planning to Transfer Assets

Suppose you’ve thought about investing in crypto or you currently own some. In that case, you may be wondering how these assets can be passed down since there are no standard legal procedures and holding crypto and moving it around looks different than the traditional finance framework.

The main issue in passing down digital assets and cryptocurrencies is the storage and transfer of the private key. Since it must be stored in a private location, it’s not recommended to write the private phrase in a will, as wills go through probate and become public records. In certain situations, the contents of safety deposit boxes may also become part of the public probate record, so storing the keys there may not work either.

So, how can you store the private key and ensure that the assets are passed on securely? Luckily, technology solutions have been built and are constantly being developed.

One of the best solutions currently available is using a multi-signature (or multi-sig) wallet. These wallets have multiple sets of keys and the wallet requires several of those signatures to complete a transaction. For example, if a wallet had 5 keys, two of them could be given to your attorney and the issuing company, and the remaining three could be held by you, your spouse, and your child. Then upon death, the assets in that wallet could be accessed by using a combination of 3 of the 5 keys. This allows for more security and helps mitigate the risk of someone inappropriately distributing or accessing the assets.

If you are holding your crypto assets in a non-custodial wallet, your estate planning may be better accomplished with a trust. This avoids probate and can allow the original owner to maintain control. And depending on the type of trust, the original owner may also set certain rules for how the assets are managed after death.

Custodial wallets (those provided by exchanges) generally cannot be included in a trust, so those assets would be subject to probate. This is another reason why some investors prefer to hold their larger amounts of crypto in their private, non-custodial wallets.

The Takeaway

It’s estimated that 20% of bitcoin is lost forever due to forgotten or misplaced seed phrases or simply not keeping inventory and forgetting it was owned in the first place. As cryptocurrency and digital assets make their way into more investing conversations, the need for education and proper asset management is becoming more important.

Keeping track of your holdings, ensuring the cryptocurrency you hold is in a secure wallet, and beginning to think about estate planning solutions are a few ways you can begin safeguarding and building a plan to pass down your digital assets.

1 Manoylov, MK. Google Search Volume for Cryptocurrency Topics Break All-Time High. The Block. May 20, 2021.

2 Reinicke, Carmen. One in Ten People Currently Invest in Cryptocurrencies. CNBC. August 24, 2021.

This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.