U.S. GDP Components and 2025 Trends

October 25, 2025 Author: Tess Downing, MBA, CFP®, Complete View Financial

U.S. GDP Components and 2025 Trends

GDP measures the value of all goods and services produced in the U.S. In 2025, it dipped in Q1 but rebounded in Q2, reminding us that the economy is driven by four main components—consumer spending, business investment, government activity, and trade. Knowing how these pieces move helps explain both the short-term shifts and the long-term picture of growth. Here are some key highlights:

GDP Rebound in Q2 2025

After a rare dip in Q1 (-0.5%), U.S. GDP bounced back with 3.0% growth in Q2, resuming its multi-year upward trend.

Core Components of GDP

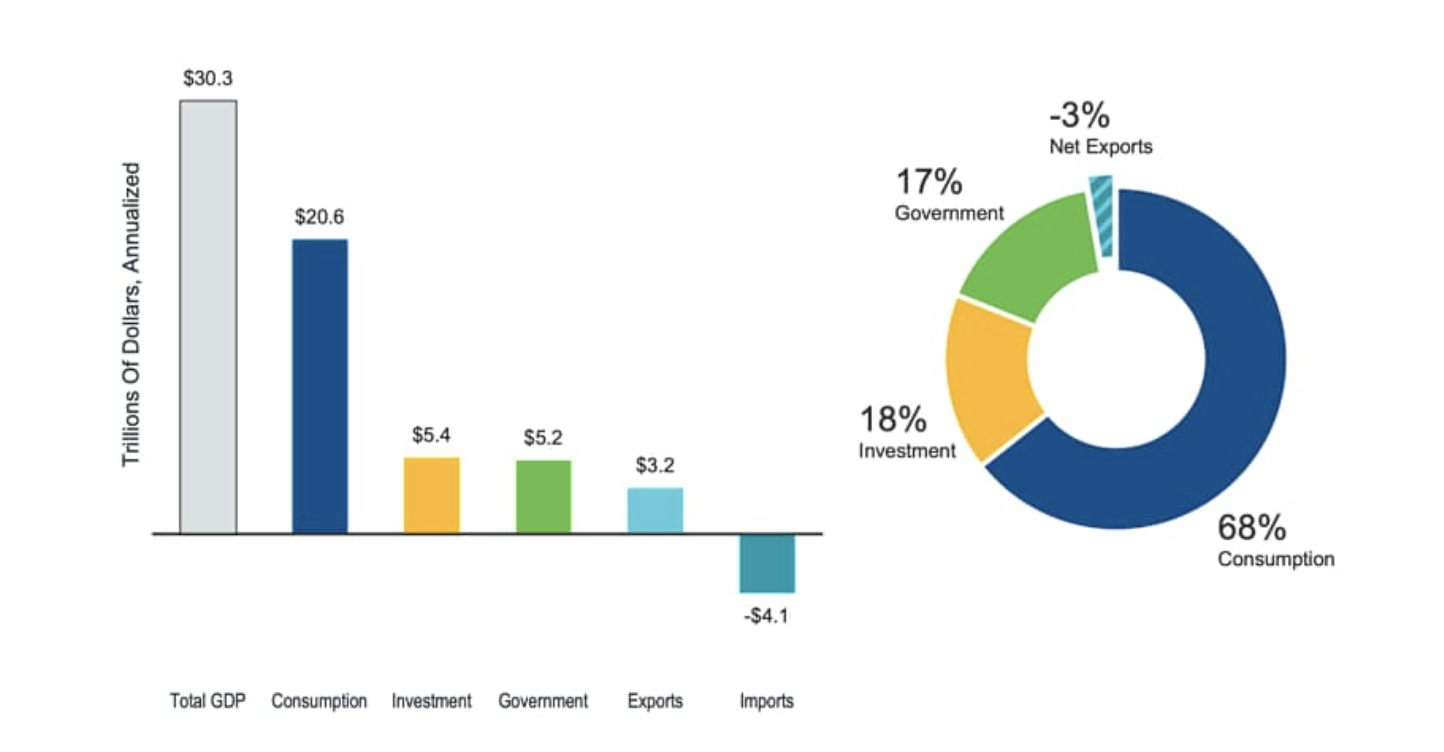

GDP is built on four demand categories:

- Personal Consumption ($20.6T) – the largest driver, covering goods and services like cars, food, and healthcare.

- Business Investment ($5.4T) – equipment, structures, and inventories.

- Government Consumption ($5.2T) – direct spending on goods and services (excluding transfers like Social Security).

- Net Exports (-$0.9T) – exports of $3.2T minus imports of $4.1T.

Trade Policy Effects in 2025

Q1: Businesses stockpiled imports ahead of new tariffs, boosting inventories but dragging GDP negative.

Q2: Imports dropped sharply, while consumption ticked up—lifting GDP back into positive growth.

Context Matters

Quarterly GDP reports capture short-term shifts, but the long-term U.S. growth trends remain strong. Both GDP and equities have grown significantly over the decades, despite experiencing short-term downturns.

Total U.S. GDP by Demand Category in Q2 2025

In the second quarter of 2025, total U.S. GDP was about $30.3 trillion. The largest share came from personal consumption ($20.6T), covering everyday goods and services such as food, cars, and healthcare. Business investment ($5.4T) was contributed through spending on equipment, structures, and inventories, while government consumption ($5.2T) reflected direct purchases, such as defense and infrastructure (excluding transfers, like Social Security). Finally, net exports were negative (-$0.9T), since imports ($4.1T) exceeded exports ($3.2T), reducing overall GDP

Data from 3/31/2025-6/30/2025. Source: Avantis Investors, Bureau of Economic Analysis.

What This Means for Investors

Investor Takeaway

Short-term GDP shifts and economic headlines may spark market noise, but they rarely define long-term outcomes. Over the decades, markets have grown steadily despite temporary setbacks. History shows that staying invested—through volatility and uncertainty—rewards investors who remain patient, disciplined, and focused on their long-term goals.

- Markets often move independently of quarterly GDP reports: A single weak quarter doesn’t necessarily signal a recession, just as a strong quarter doesn’t guarantee sustained growth.

- Focus on long-term economic growth: Over decades, U.S. GDP has expanded steadily despite recessions, wars, inflation cycles, and financial crises. Similarly, long-term investors who stayed invested have historically been rewarded.

- GDP is a backdrop, not a timing tool: GDP trends can help explain the environment—whether growth is being driven by consumer spending, business investment, or government policy—but they are not reliable for short-term market timing.

- Patience and diversification matter more: Because GDP reflects the entire economy, it reinforces why broad, diversified portfolios tend to benefit from long-term growth, even if some sectors are hit harder during downturns.

Bottom Line

GDP headlines may influence short-term sentiment, but they are not reliable signals for market timing. A weak quarter doesn’t mean recession is imminent, and a strong one doesn’t guarantee lasting growth. Over time, both GDP and markets have advanced despite wars, recessions, and financial crises. For investors, the lesson is clear: treat GDP as a useful context, not a forecast, and stay focused on patience, discipline, and diversification to capture the benefits of long-term growth.